At a Glance

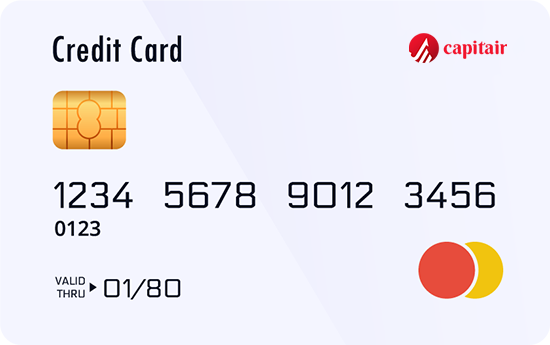

Earn cash back on every purchase! The Capitair CashBack Card delivers a straightforward cashback program, and you’ll be surprised by how quickly your cash back adds up. Capitair customers can apply in a branch, via phone or digitally if registered for Online or Mobile banking.